My Money Story

As a solo business owner, it’s so important to have a handle on your finances (because, for real, businesses need to make money!) I’ve been working on getting a handle on my own personal finances since I made the leap to full-time entrepreneurship in 2014. This year, as I begin to feel a bit more confident around money and my business, I decided to start sharing my personal money journey in the hope that it would be helpful for other creative business owners.

>>This post is super long. Don’t want to read it? Listen to my money story (Episode 56) on the Behind the Brand Podcast!<<

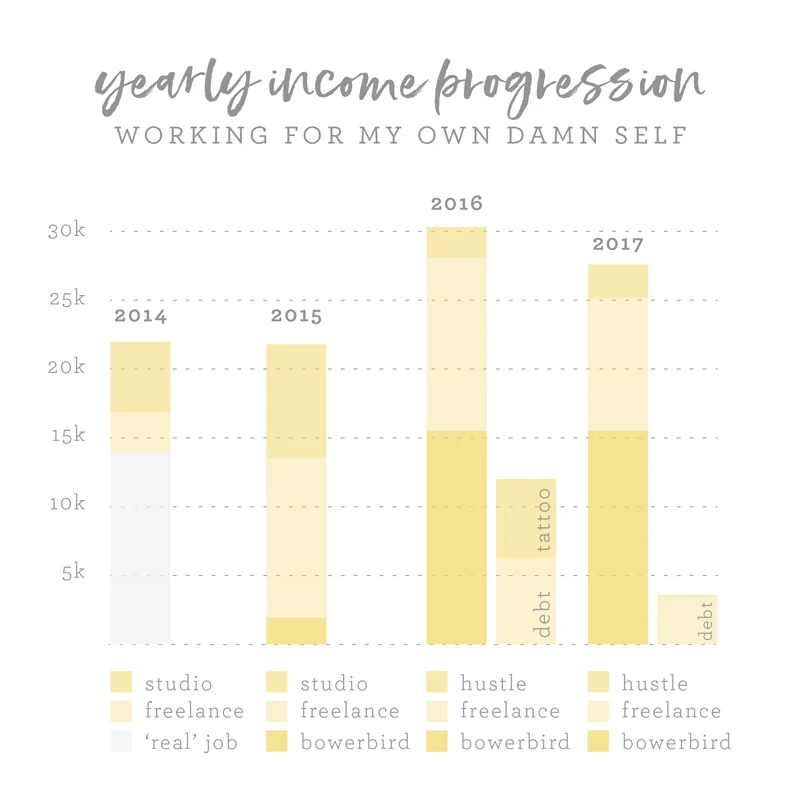

In 2014, I was making $2,400 a month working full-time at a creative studio. I was terrified to make the leap to self-employment, but luckily my Mom was willing to support me if needed, which gave me the safety net to quit my job. (And, I never actually had to take her up on that offer!) At the same time, I found a local florist looking for extra help, and though I had absolutely no experience I knew that time spent off the computer working with my hands and gaining wedding industry experience would be super valuable (and bring in a bit of extra cash while I got my business off the ground).

The first six months of self-employment were slow going, but I was able to make $3,000 in graphic design income, and $5,300 working as a floral freelancer. Plus, I had some money in the bank from my full-time job, so though my budget was extremely lean I proved to myself that I could in fact go the solo road!

In 2015, I teamed up with a fellow floral freelancer to form Bowerbird Atelier. After all of our expenses, and being a new company, I only made $2,000 through the business that first year, but I continued to do other design jobs on the side (I made $12,000 after taxes from those) and pulled in about $8,500 from floral freelancing. So, year one of being fully self-employed netted me $22,500. Not bad for a first year of entrepreneurship! Although, I was definitely paying myself job-by-job, and I was horrible at saving (but I was great at saving for government taxes).

My word of the year for 2016 was debt. I was $15,616.49 in the hole, which was a mix of student loans and credit cards. I discovered the Dear Debt blog and got super inspired to knock out my debt payments. There were so many stories of people paying off tens of thousands of dollars in debt in a year, so I could totally do $15k!

But, as we all know, life doesn’t happen in a vacuum. I had the opportunity to work with an incredible tattoo artist who is really hard to book, and I leapt at the chance. Although I knew this wouldn’t help my getting-out-of-debt situation, I was determined to save up for the tattoo so that I could at least control not going into more debt for it. I hustled super hard all year, and was able to stash away all $5,200 for the tattoo in cash. Outside of that huge expense, I made $16,000 from Bowerbird, $13,000 from side design work and floral freelancing, and $2,348.78 in random side-hustle money (which included selling some of my clothes + books, and selling our recycling!). 2016 as a whole netted me $31,910, and aside from the huge tattoo expense, I was also able to pay off $6,495.58 in debt and save $700.

Tattoo: Totally worth it.

Now, by the end of 2016, I definitely wasn’t out of debt - but I had proven to myself that A) I could pre-save for a huge expense and B) that I could make a living working for myself, especially if I hustled hard. I started tracking my income more heavily, but I was still paying myself job-by-job after taxes.

With two full years of self-employment under my belt, 2017 was the year of projecting my quarterly revenue. I knew around what I could expect to make, and set a revenue goal of 100K for the year based on that historical data.

I didn’t quite make this goal (I pulled in $15,994.51 from Bowerbird, $9,979.58 in side design work and floral freelancing, and $2,515.47 in hustle money) but I did pay down $3,640.00 in debt. And hilariously, since I didn’t have a big personal savings goal, I literally only stashed away $100 in savings. But, not hustling towards a goal had also only netted me $28,495.05, so slightly less than I had made in 2016. This year also marked the end of my partnership, so Bowerbird Atelier became my solo business venture.

After two years of making basically the income I had coming in with a full-time job, I was hooked on self-employment. And I knew that as a solopreneur, I had unlimited earning potential. If I wanted to hustle hard, I could make more than I would ever pull in working for someone else.

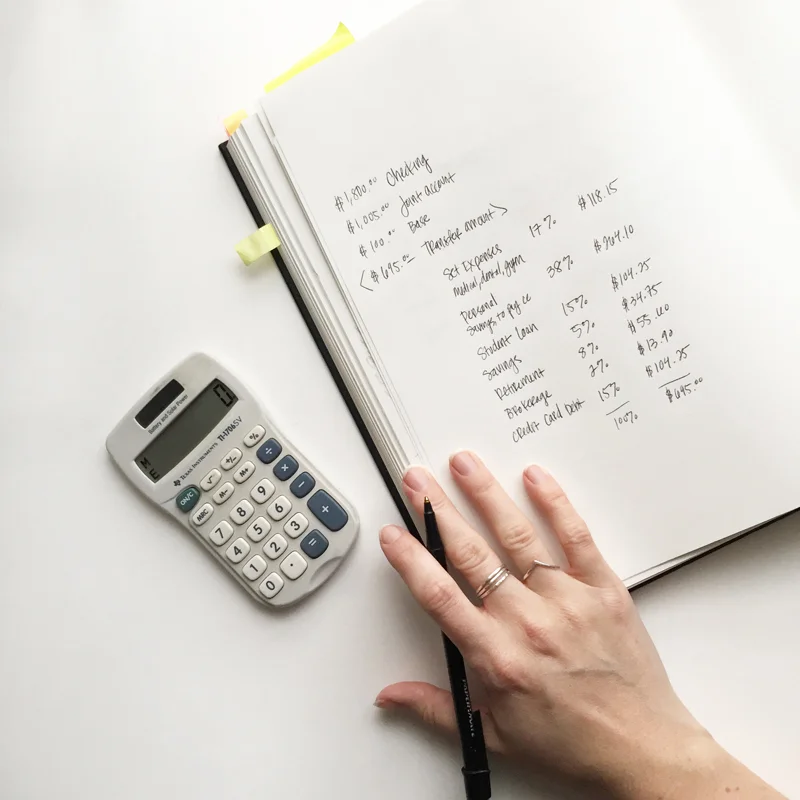

My Mom (being the money guru she is) is an accountant, and she also became Profit First certified around this time. So, in January of 2018 I was her first guinea pig client, and she helped me transition my business finances to the Profit First system. This was a total game changer, because it forced me to commit to pulling a monthly salary, as opposed to paying myself job-by-job. And, having a set income each month (which I was able to do knowing historically what I could expect to make for the year) allowed me to focus on my personal finances and my budget outside of my biz.

I was on the path to having a healthy bank account, but things were still a bit rough on the money front. There were a few clients I was literally chasing down for small $100-$200 invoices. I felt super desperate and decided I didn’t want to run my biz that way. And then three things happened in one week that really propelled me forward: I discovered Jen Sincero’s book You Are A Badass at Making Money, I came across the Work Your Wealth Podcast, and I signed up for a course from Yes & Yes Blog called More Money + More Happy.

I had a total lightbulb moment with these discoveries: all of these women went through similar money journeys to me, and decided to start sharing about it after they came out the other side. But, you don’t see a lot of people being transparent when they’re in the thick of it, especially when it’s not working. I knew I could help people by sharing and posting about being in the trenches as I work through my money, and I felt like talking about money shouldn’t be this XXX topic.

I definitely have a long way to go on my money journey, and slip-ups keep happening, but I’m feeling so much better about sharing where I’m at and helping other people get a handle on their finances.

Code name: Barbie Dream Kitchen